Business

Weighing Investment Options: Dubai or Birmingham Property Market?

The decision to invest in real estate can significantly impact financial futures, prompting many to consider locations with contrasting opportunities. A reader recently sought advice on whether to purchase a rental property in the rapidly growing market of Dubai, United Arab Emirates, or to opt for the more stable but quieter environment of Birmingham, United Kingdom.

Rental property investments in Dubai have gained notable attention due to the booming economy and influx of expatriates. According to the Dubai Land Department, the property market witnessed a remarkable growth rate of 30% in 2022, fueled by a surge in demand for residential units. The city’s appeal lies in its luxurious lifestyle, tax-free income, and ongoing development projects that promise high returns for investors.

In contrast, the UK market, particularly in Birmingham, offers a different set of advantages. Birmingham has been experiencing a revitalization, with significant urban development and infrastructure improvements. The city is projected to see a rental growth of around 15% over the next five years, according to Savills, a global real estate services provider. This growth, combined with a stable rental market, makes Birmingham an attractive option for investors seeking long-term returns.

Investors must weigh various factors when choosing between these two distinct markets. In Dubai, the high potential for short-term rental income is appealing, especially with the increasing number of tourists and expatriates. However, the market can be volatile, influenced by economic fluctuations and changes in government regulations. Moreover, prospective investors should consider additional costs such as property management fees and maintenance.

On the other hand, Birmingham presents a more predictable investment landscape. Its strong rental demand, driven by a large student population and a growing workforce, provides a steady income for landlords. The UK’s regulatory framework also offers more protections for tenants and landlords alike, which can add a layer of security for property owners.

Investors are encouraged to conduct thorough research and possibly engage with local real estate experts to gain insights into both markets. For example, Mark Smith, a landlord advisor, suggests that potential buyers in Dubai should focus on areas like Dubai Marina or Downtown Dubai, where property values are expected to rise further. Conversely, in Birmingham, neighborhoods such as Selly Oak and Digbeth are highlighted for their burgeoning rental prospects due to ongoing regeneration initiatives.

Ultimately, the choice between investing in Dubai or Birmingham hinges on individual investment goals and risk tolerance. While Dubai offers lucrative short-term gains, Birmingham provides stability and long-term growth potential. Investors must assess their financial objectives thoroughly before making a decision, ensuring they align with the unique characteristics of each market.

-

Health2 months ago

Health2 months agoNeurologist Warns Excessive Use of Supplements Can Harm Brain

-

Health2 months ago

Health2 months agoFiona Phillips’ Husband Shares Heartfelt Update on Her Alzheimer’s Journey

-

Science6 days ago

Science6 days agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Science4 days ago

Science4 days agoNASA Investigates Unusual Comet 3I/ATLAS; New Findings Emerge

-

World2 months ago

World2 months agoCole Palmer’s Cryptic Message to Kobbie Mainoo Following Loan Talks

-

Entertainment3 months ago

Entertainment3 months agoKerry Katona Discusses Future Baby Plans and Brian McFadden’s Wedding

-

Science2 days ago

Science2 days agoScientists Examine 3I/ATLAS: Alien Artifact or Cosmic Oddity?

-

Entertainment3 months ago

Entertainment3 months agoEmmerdale Faces Tension as Dylan and April’s Lives Hang in the Balance

-

Entertainment3 months ago

Entertainment3 months agoLove Island Star Toni Laite’s Mother Expresses Disappointment Over Coupling Decision

-

Entertainment2 months ago

Entertainment2 months agoMajor Cast Changes at Coronation Street: Exits and Returns in 2025

-

World2 months ago

World2 months agoCoronation Street’s Asha Alahan Faces Heartbreaking Assault

-

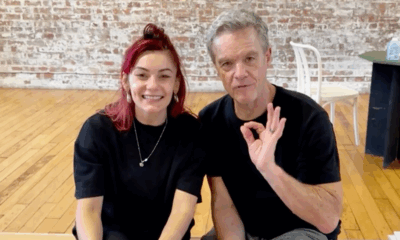

Entertainment2 weeks ago

Entertainment2 weeks agoStefan Dennis and Dianne Buswell Share Health Update on Strictly Come Dancing