Business

Martin Lewis Raises Concerns Over Potential State Pension Changes

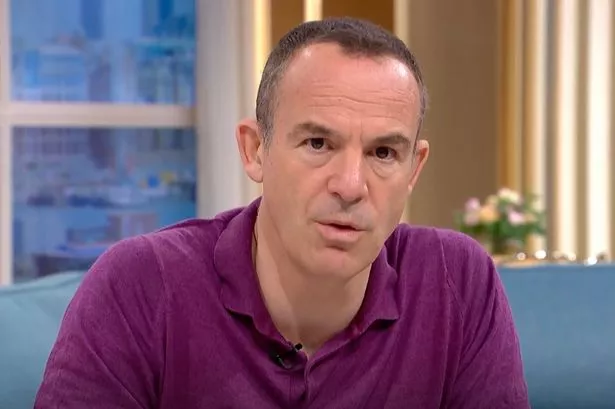

Financial expert Martin Lewis has issued a warning regarding the future of the State Pension, suggesting that it could potentially be replaced by a means-tested system. During a recent episode of his podcast, Lewis discussed the implications of the upcoming 4.7 percent increase in the State Pension, which is set to take effect in April 2024.

When a caller inquired whether the State Pension could be scrapped, Lewis responded affirmatively, stating, “Yes, it is possible.” He elaborated on the broader implications of potential changes, emphasizing that Parliament holds the authority to legislate any adjustments it sees fit.

Future Changes and Likelihood of Adjustments

Lewis expressed skepticism regarding the likelihood of the State Pension being entirely eliminated, suggesting instead that increasing the qualifying age for receiving the pension is a more probable outcome. He indicated that individuals currently aged 18 may not see their pensions until they are in their 70s, rather than their late 60s.

He outlined various risks to the State Pension system, placing the increase in age as the most likely change, followed by a means-tested approach as a less probable, yet noteworthy, possibility within the next 20 to 30 years.

This discussion follows the announcement from the Office for National Statistics (ONS) on September 16, 2023, confirming the pension rise of 4.7 percent after labor market figures indicated a growth in average earnings. This increase raises questions about the long-term viability of the triple-lock guarantee, which ensures that pensions rise with inflation, average earnings growth, or by a minimum of 2.5 percent, whichever is highest.

Tax Implications for Pensioners

Lewis also highlighted concerns regarding potential tax implications for pensioners. He noted that for the first time, individuals receiving the full new state pension will likely be required to pay income tax due to the rise in pension amounts exceeding the frozen personal allowance.

According to Lewis, the new state pension is set to increase from £230.24 to £241.05 per week, while the old state pension will rise from £176.45 to £184.75 per week. This adjustment brings the annual income for those on the full new state pension to £12,535, only £35 below the current frozen personal allowance threshold, which limits tax-free earnings.

In a post on social media platform X, Lewis underscored the significance of these changes, stating, “The State Pension is set to rise 4.7% next April… the final figure has just come in, for earnings up to July and it’s the highest of the three.”

As pensioners prepare for these changes, the conversation around the sustainability of pension systems continues to evolve, with Lewis urging individuals to stay informed about potential adjustments that could affect their financial futures.

-

Health3 months ago

Health3 months agoNeurologist Warns Excessive Use of Supplements Can Harm Brain

-

Health3 months ago

Health3 months agoFiona Phillips’ Husband Shares Heartfelt Update on Her Alzheimer’s Journey

-

Science1 month ago

Science1 month agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Science1 month ago

Science1 month agoNASA Investigates Unusual Comet 3I/ATLAS; New Findings Emerge

-

Science1 month ago

Science1 month agoScientists Examine 3I/ATLAS: Alien Artifact or Cosmic Oddity?

-

Science1 month ago

Science1 month agoNASA Investigates Speedy Object 3I/ATLAS, Sparking Speculation

-

Entertainment5 months ago

Entertainment5 months agoKerry Katona Discusses Future Baby Plans and Brian McFadden’s Wedding

-

Entertainment4 months ago

Entertainment4 months agoEmmerdale Faces Tension as Dylan and April’s Lives Hang in the Balance

-

World3 months ago

World3 months agoCole Palmer’s Cryptic Message to Kobbie Mainoo Following Loan Talks

-

Science1 month ago

Science1 month agoNASA Scientists Explore Origins of 3I/ATLAS, a Fast-Moving Visitor

-

Entertainment2 months ago

Entertainment2 months agoLewis Cope Addresses Accusations of Dance Training Advantage

-

Entertainment3 months ago

Entertainment3 months agoMajor Cast Changes at Coronation Street: Exits and Returns in 2025