Top Stories

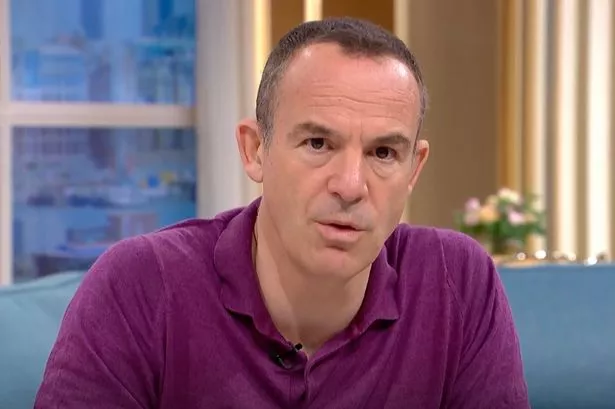

Martin Lewis Raises Concerns Over Potential State Pension Changes

Financial expert Martin Lewis has expressed serious concerns regarding the future of the State Pension in the United Kingdom. In a recent podcast, he indicated that the State Pension could potentially be replaced with a means-tested system if the current triple lock mechanism is compromised. This warning comes as the State Pension is set to rise by 4.7% in April 2024, a figure confirmed by data from the Office for National Statistics (ONS).

Lewis was responding to a caller’s question about the possibility of scrapping the State Pension altogether. He stated, “Yes, it is possible,” highlighting the legislative power of Parliament to make sweeping changes. He noted, “Parliament is what is called omnicompetent – a technical term meaning parliament can legislate anything it chooses to do. Do I think it’s likely? No.”

The founder of Money Saving Expert (MSE) elaborated on the potential risks to the State Pension system. He believes that while it is more probable that the age for receiving the pension will increase, the idea of means testing is also on the table. Lewis predicts that individuals who are currently 18 years old may not receive their State Pension until their 70s.

He outlined the risks in a ranked order, with the increase in the pension age being the most likely outcome. The potential means testing, while deemed unlikely, remains a possibility in the next 20-30 years. This perspective comes in the wake of discussions surrounding the 4.7% rise, which could lead to tax implications for some pensioners.

According to the ONS, the rise is based on newly released labour market figures indicating average earnings growth. This development raises questions about the long-term viability of the triple lock guarantee, particularly as it conflicts with the current frozen tax thresholds. Lewis warned that, “unless something changes,” those on the full new state pension with no other income may find themselves paying tax on their pension income for the first time.

The new state pension is set to increase to £12,535 annually, just £35 below the frozen personal allowance threshold, which is the amount individuals can earn tax-free each year. Lewis emphasized that this rise could result in significant financial implications for pensioners, particularly those relying solely on the State Pension for their income.

In his communication on social media, Lewis detailed the upcoming changes, stating that the full new state pension will rise from £230.24 to £241.05 per week, while the old state pension will increase from £176.45 to £184.75 per week. This adjustment represents a critical moment for many retirees, as it may impact their financial security and tax obligations moving forward.

The conversation around the State Pension highlights the complexities and potential shifts in the UK’s pension landscape, as experts like Lewis continue to advocate for clarity and caution in financial planning for the future.

-

Health2 months ago

Health2 months agoNeurologist Warns Excessive Use of Supplements Can Harm Brain

-

Health2 months ago

Health2 months agoFiona Phillips’ Husband Shares Heartfelt Update on Her Alzheimer’s Journey

-

Science2 weeks ago

Science2 weeks agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Science2 weeks ago

Science2 weeks agoNASA Investigates Unusual Comet 3I/ATLAS; New Findings Emerge

-

Science1 week ago

Science1 week agoScientists Examine 3I/ATLAS: Alien Artifact or Cosmic Oddity?

-

Entertainment4 months ago

Entertainment4 months agoKerry Katona Discusses Future Baby Plans and Brian McFadden’s Wedding

-

Science1 week ago

Science1 week agoNASA Investigates Speedy Object 3I/ATLAS, Sparking Speculation

-

World2 months ago

World2 months agoCole Palmer’s Cryptic Message to Kobbie Mainoo Following Loan Talks

-

Entertainment3 months ago

Entertainment3 months agoEmmerdale Faces Tension as Dylan and April’s Lives Hang in the Balance

-

Science1 week ago

Science1 week agoNASA Scientists Explore Origins of 3I/ATLAS, a Fast-Moving Visitor

-

Entertainment4 months ago

Entertainment4 months agoLove Island Star Toni Laite’s Mother Expresses Disappointment Over Coupling Decision

-

Entertainment2 months ago

Entertainment2 months agoMajor Cast Changes at Coronation Street: Exits and Returns in 2025