Business

HMRC Offers £1,200 Bonus to 7.5 Million Universal Credit Recipients

HM Revenue and Customs (HMRC) has informed approximately 7.5 million individuals receiving Universal Credit that they may be eligible for a cash bonus of up to £1,200. This initiative is part of the Help to Save scheme, which offers a 50p bonus for every £1 saved over a four-year period.

The announcement, made via social media on platform X, outlines that those on Universal Credit can benefit from this savings account designed to encourage financial resilience. As of August 2025, the number of individuals on Universal Credit has increased from 6.4 million in January 2024.

Under the Help to Save scheme, participants can deposit between £1 and £50 each month, with no requirement to contribute every month. The government guarantees that all savings within the scheme are secure. Payments can be made through debit card, standing order, or bank transfer.

HMRC stated: “You can pay in as many times as you like, but the most you can pay in each calendar month is £50. For example, if you have saved £50 by 8 January, you will not be able to pay in again until 1 February.”

Withdrawals from the Help to Save account can only be made to a bank account. Bonuses are awarded at the end of the second and fourth years, based on the total amount saved. After four years, the account will close, and individuals will not be able to reopen it or create a new one.

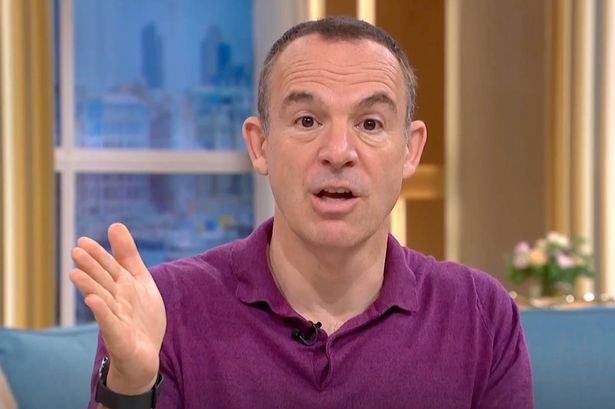

Martin Lewis, the founder of Money Saving Expert, has endorsed the Help to Save scheme, describing it as “unbeatable.” He emphasized its risk-free nature and encouraged individuals on Universal Credit to take advantage of this opportunity. On social media, he noted: “If you know anyone on Universal Credit especially please do share this with them. It’s an unbeatable form of savings that can add serious cash with no risk.”

To illustrate the potential benefits, Lewis explained that if a participant saves the maximum of £50 a month for a year, they could accumulate £600. If unexpected expenses arise, such as a broken appliance, they could withdraw the entire amount but still receive a bonus based on the highest balance saved.

For instance, if their highest balance was £600, they would receive a bonus of £300 after the two-year mark. After the subsequent two years, if their highest balance increases to £800, they would receive an additional £100 bonus, totaling £400 for a maximum contribution of £2,400 over four years.

Since its launch in September 2018, nearly half a million savers have taken part in the Help to Save initiative, with a total of £372.5 million deposited into accounts. Myrtle Lloyd, HMRC’s Director General for Customer Services, highlighted the scheme’s accessibility, stating: “Hundreds of thousands of people are benefitting from Help to Save. It’s a great way of saving whatever you can, and the government will top up your savings by 50%. It’s quick and easy to apply online or via the HMRC app.”

Individuals interested in applying can find more information and access the application process by searching for “Help to Save” on GOV.UK. This initiative represents a significant opportunity for those on Universal Credit to enhance their savings and financial stability.

-

Health3 months ago

Health3 months agoNeurologist Warns Excessive Use of Supplements Can Harm Brain

-

Health3 months ago

Health3 months agoFiona Phillips’ Husband Shares Heartfelt Update on Her Alzheimer’s Journey

-

Science2 months ago

Science2 months agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Science2 months ago

Science2 months agoNASA Investigates Unusual Comet 3I/ATLAS; New Findings Emerge

-

Science1 month ago

Science1 month agoScientists Examine 3I/ATLAS: Alien Artifact or Cosmic Oddity?

-

Entertainment5 months ago

Entertainment5 months agoKerry Katona Discusses Future Baby Plans and Brian McFadden’s Wedding

-

Science1 month ago

Science1 month agoNASA Investigates Speedy Object 3I/ATLAS, Sparking Speculation

-

Entertainment4 months ago

Entertainment4 months agoEmmerdale Faces Tension as Dylan and April’s Lives Hang in the Balance

-

World3 months ago

World3 months agoCole Palmer’s Cryptic Message to Kobbie Mainoo Following Loan Talks

-

Science1 month ago

Science1 month agoNASA Scientists Explore Origins of 3I/ATLAS, a Fast-Moving Visitor

-

Entertainment2 months ago

Entertainment2 months agoLewis Cope Addresses Accusations of Dance Training Advantage

-

Entertainment4 months ago

Entertainment4 months agoMajor Cast Changes at Coronation Street: Exits and Returns in 2025