World

Trump Proposes $2,000 Tariff Rebate, Odds Remain Slim for 2026

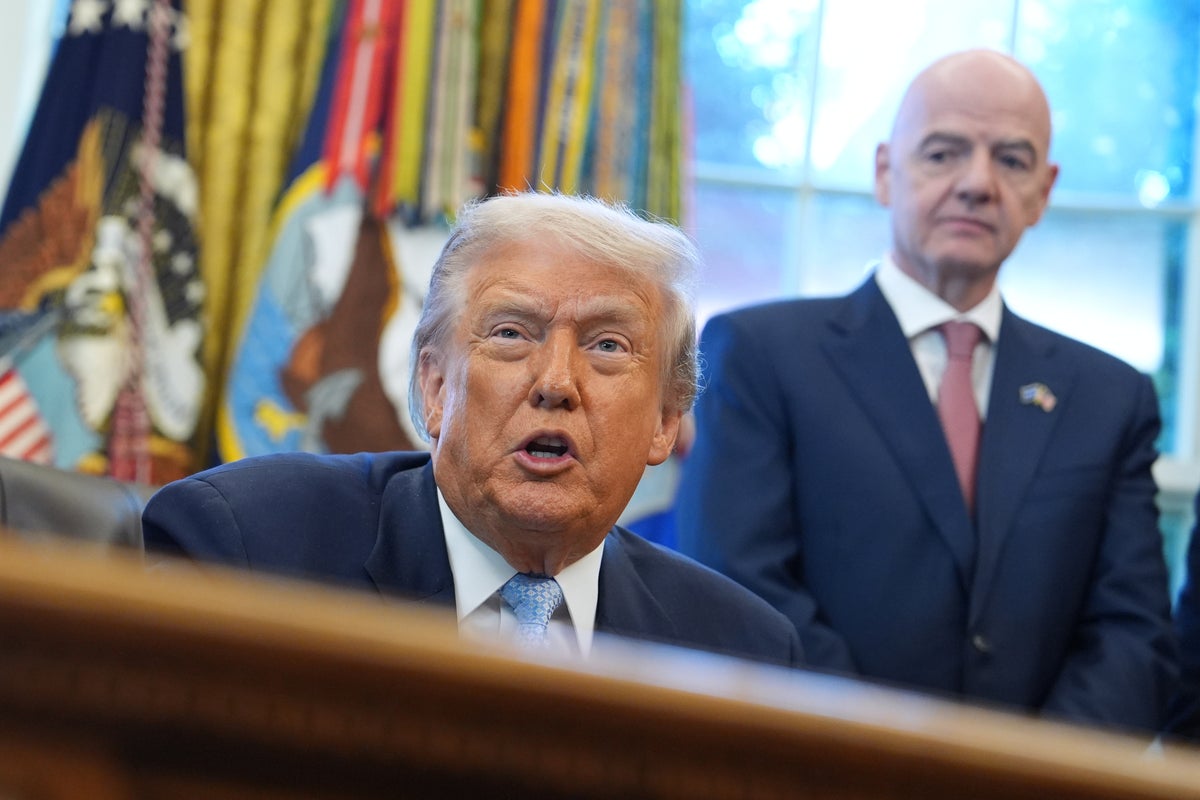

President Donald Trump has proposed sending $2,000 rebate checks to Americans, suggesting that the funding could come from tariffs central to his economic agenda. This announcement, made on November 10, 2023, via his social media platform Truth Social, aimed to provide financial relief to many citizens. However, the likelihood of this initiative materializing appears to be exceedingly low, with betting markets giving it a mere 2 percent chance of occurring by January 2026.

The proposal, described by Trump as a “dividend of at least $2,000 a person (not including high income people!)”, is ambitious but faces significant hurdles. Analysts express skepticism regarding its feasibility, emphasizing the high costs involved. According to the odds market website Kalshi, the chances of these rebate checks being distributed have sharply declined from a high of 13 percent shortly after the announcement. Another platform, Polymarket, currently places the odds at just 1 percent, a stark drop from 50 percent earlier in November.

Concerns about the economic implications of Trump’s plan have been voiced by prominent economists. A recent report from the Yale Budget Lab estimates that a one-time rebate for Americans earning under $100,000 would cost around $450 billion. This figure is approximately double the total revenue expected from the administration’s tariff increases by 2026. The analysis further indicates that while the cash infusion could provide a modest boost to GDP growth and employment—by 0.6 and 0.15 percentage points respectively—the benefits would diminish over time.

Inflation is another concern, with the Yale Budget Lab estimating a minimal increase of less than 0.1 percentage points in the coming years as a result of the rebates.

In an interview with ABC News on November 9, 2023, Scott Bessent, the Treasury Secretary, expressed ambivalence regarding the rebate plan. He noted that he had not discussed the specifics with Trump and suggested that the tariff dividend could take various forms, not necessarily as direct checks. “It could… come in lots of forms, in lots of ways,” Bessent explained. He highlighted that some benefits could manifest as tax reductions rather than cash payouts.

Bessent’s cautious stance reflects broader concerns about the financial ramifications of the proposed rebates. As reported by Fortune, issuing these checks could complicate Trump’s stated goal of utilizing tariff revenue to address the national debt. While tariffs currently generate approximately $30 billion monthly, this revenue is dwarfed by the annual $1.2 trillion spent on national debt interest payments. “Even if President Trump’s tariff collection continues to rake in $30 billion a month and $360 billion a year, this still amounts to a little over a third of the interest payments on the debt—it doesn’t touch the debt itself,” Fortune noted.

As the political landscape continues to evolve, the prospects for Trump’s rebate checks remain uncertain, with analysts and officials weighing the potential costs against the benefits. The proposal serves as a reflection of the ongoing debate surrounding fiscal policy and economic support for American citizens.

-

Health3 months ago

Health3 months agoNeurologist Warns Excessive Use of Supplements Can Harm Brain

-

Health3 months ago

Health3 months agoFiona Phillips’ Husband Shares Heartfelt Update on Her Alzheimer’s Journey

-

Science1 month ago

Science1 month agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Science1 month ago

Science1 month agoNASA Investigates Unusual Comet 3I/ATLAS; New Findings Emerge

-

Science4 weeks ago

Science4 weeks agoScientists Examine 3I/ATLAS: Alien Artifact or Cosmic Oddity?

-

Science4 weeks ago

Science4 weeks agoNASA Investigates Speedy Object 3I/ATLAS, Sparking Speculation

-

Entertainment4 months ago

Entertainment4 months agoKerry Katona Discusses Future Baby Plans and Brian McFadden’s Wedding

-

Entertainment4 months ago

Entertainment4 months agoEmmerdale Faces Tension as Dylan and April’s Lives Hang in the Balance

-

World3 months ago

World3 months agoCole Palmer’s Cryptic Message to Kobbie Mainoo Following Loan Talks

-

Science4 weeks ago

Science4 weeks agoNASA Scientists Explore Origins of 3I/ATLAS, a Fast-Moving Visitor

-

Entertainment4 months ago

Entertainment4 months agoLove Island Star Toni Laite’s Mother Expresses Disappointment Over Coupling Decision

-

Entertainment3 months ago

Entertainment3 months agoMajor Cast Changes at Coronation Street: Exits and Returns in 2025