Business

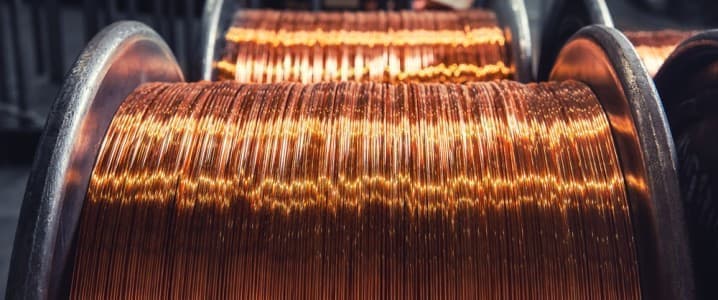

U.S. Copper Tariffs Threaten Industry Stability and Consumer Prices

Proposed tariffs of 50 percent on imported copper by the Trump administration could lead to significant price increases for American industries and consumers. The United States relies heavily on imports to meet its copper demands, sourcing approximately 45 percent of its needs from abroad. Such tariffs aim to protect domestic production but may create a ripple effect throughout the economy.

The prospect of higher copper prices raises concerns for various sectors that depend on this essential metal, including construction and electronics. Products containing copper are ubiquitous, making the potential impact of these tariffs particularly far-reaching. Analysts warn that while tariffs could temporarily bolster domestic copper mining and refining, they may also lead to inflationary pressures on consumer goods.

Challenges in Domestic Production

Building new copper mining and refining facilities is a complex and time-consuming process. It can take years to develop a mine, particularly if the location of copper deposits is not already known. The challenge is compounded by the reluctance of local communities to accept new mining or refining operations in their vicinity. Opposition can delay projects for extended periods, if not halt them altogether.

Furthermore, the economic viability of new facilities hinges on the expectation that copper prices will remain elevated. Investors are unlikely to commit to such long-term projects without confidence that tariffs will not be rescinded in the near future. If copper prices fall after investments are made, the profitability of these new operations could be jeopardized, placing additional strain on the industry.

Implications for U.S. Industry and Consumers

The proposed tariffs serve as a bargaining position rather than a definitive policy. The unpredictability surrounding the implementation of these tariffs raises questions about their long-term effectiveness. Market sentiment suggests skepticism about whether the administration will follow through on such dramatic measures.

In the broader context, while the U.S. aims for greater self-sufficiency in minerals, the reality is that significant challenges remain. The country may lack sufficient in-ground resources or face high costs in developing existing ones. Achieving self-sufficiency would likely require either sustained tariffs that could burden domestic industries reliant on these minerals or substantial government subsidies, which may not resonate well with the public.

The ongoing debate over copper tariffs highlights the delicate balance between national interests and economic realities. As the situation evolves, stakeholders across the industry will be closely monitoring developments to assess their potential impact on both business operations and consumer prices.

-

Health3 months ago

Health3 months agoNeurologist Warns Excessive Use of Supplements Can Harm Brain

-

Health3 months ago

Health3 months agoFiona Phillips’ Husband Shares Heartfelt Update on Her Alzheimer’s Journey

-

Science1 month ago

Science1 month agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Science1 month ago

Science1 month agoNASA Investigates Unusual Comet 3I/ATLAS; New Findings Emerge

-

Science4 weeks ago

Science4 weeks agoScientists Examine 3I/ATLAS: Alien Artifact or Cosmic Oddity?

-

Science4 weeks ago

Science4 weeks agoNASA Investigates Speedy Object 3I/ATLAS, Sparking Speculation

-

Entertainment4 months ago

Entertainment4 months agoKerry Katona Discusses Future Baby Plans and Brian McFadden’s Wedding

-

Entertainment4 months ago

Entertainment4 months agoEmmerdale Faces Tension as Dylan and April’s Lives Hang in the Balance

-

World3 months ago

World3 months agoCole Palmer’s Cryptic Message to Kobbie Mainoo Following Loan Talks

-

Science4 weeks ago

Science4 weeks agoNASA Scientists Explore Origins of 3I/ATLAS, a Fast-Moving Visitor

-

Entertainment4 months ago

Entertainment4 months agoLove Island Star Toni Laite’s Mother Expresses Disappointment Over Coupling Decision

-

Entertainment3 months ago

Entertainment3 months agoMajor Cast Changes at Coronation Street: Exits and Returns in 2025