Business

Wise Shareholders Approve US Listing and Dual-Class Structure Extension

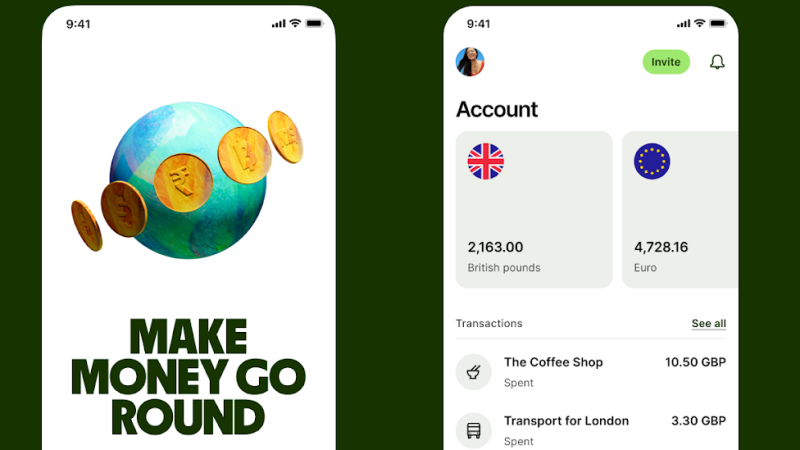

Wise shareholders have voted overwhelmingly in favor of relocating the company’s listing from London to New York, a decision tied to a controversial extension of its dual-class share structure. This move marks a significant shift for the money transfer firm, which initially floated on the London Stock Exchange in 2021.

The dual-class share structure, designed to concentrate control among a small group of investors, was originally set to expire in 2026. However, the recent vote included a proposal to extend this structure until 2036. Critics, including Wise co-founder Taavet Hinrikus, who holds over five percent of the company through his Skaala Investments OÜ vehicle, voiced concerns about the “all or nothing” nature of the vote. Proxy advisory firms, such as Pirc, also opposed the proposal, arguing it undermined shareholder rights.

Despite this backlash, the results were decisive. Approximately 91% of class A shareholders and 84.5% of class B shareholders supported the resolution to relocate the listing and extend the dual-class share structure. Chair of Wise, David Wells, expressed satisfaction with the outcome, stating, “We’re pleased that our owners have overwhelmingly approved the proposal, giving us a strong mandate to proceed.”

Implications of the Decision

This decision to shift the listing to New York highlights Wise’s strategy to capitalize on the U.S. market’s growth potential. The company aims to enhance its visibility and attract a broader investor base, which could potentially lead to increased capital and expansion opportunities. The dual-class share structure allows existing investors to maintain significant control over the company, which proponents argue is vital for long-term strategic decisions.

The transition to the New York Stock Exchange is expected to provide Wise with greater access to capital markets, tapping into a larger pool of investors who may be more familiar with the company’s operations and growth trajectory.

As Wise prepares for this significant transition, it remains to be seen how the extended dual-class structure will impact corporate governance and shareholder engagement in the future. The substantial support from shareholders indicates a level of trust in the management’s vision and strategy moving forward.

The relocation of Wise’s listing is not just a logistical change; it signifies a broader ambition as the company seeks to establish itself firmly within the competitive landscape of international finance. The successful vote reflects a commitment from shareholders to back the company’s strategic direction, despite the controversies surrounding control and governance.

-

Health3 months ago

Health3 months agoNeurologist Warns Excessive Use of Supplements Can Harm Brain

-

Health3 months ago

Health3 months agoFiona Phillips’ Husband Shares Heartfelt Update on Her Alzheimer’s Journey

-

Science2 months ago

Science2 months agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Science2 months ago

Science2 months agoNASA Investigates Unusual Comet 3I/ATLAS; New Findings Emerge

-

Science1 month ago

Science1 month agoScientists Examine 3I/ATLAS: Alien Artifact or Cosmic Oddity?

-

Entertainment5 months ago

Entertainment5 months agoKerry Katona Discusses Future Baby Plans and Brian McFadden’s Wedding

-

Science1 month ago

Science1 month agoNASA Investigates Speedy Object 3I/ATLAS, Sparking Speculation

-

Entertainment4 months ago

Entertainment4 months agoEmmerdale Faces Tension as Dylan and April’s Lives Hang in the Balance

-

World3 months ago

World3 months agoCole Palmer’s Cryptic Message to Kobbie Mainoo Following Loan Talks

-

Science1 month ago

Science1 month agoNASA Scientists Explore Origins of 3I/ATLAS, a Fast-Moving Visitor

-

Entertainment2 months ago

Entertainment2 months agoLewis Cope Addresses Accusations of Dance Training Advantage

-

Entertainment3 months ago

Entertainment3 months agoMajor Cast Changes at Coronation Street: Exits and Returns in 2025