Business

Martin Lewis Urges 2.6 Million Households to Claim £1,300 Annually

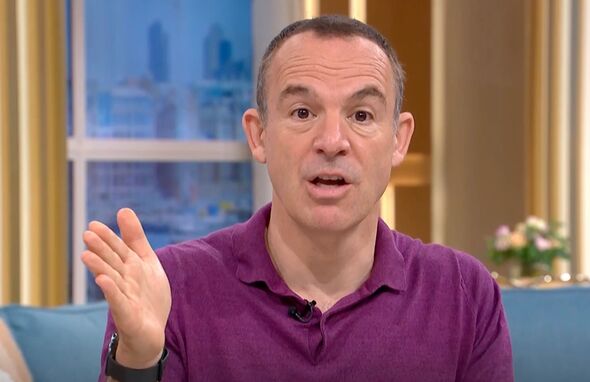

Martin Lewis, the well-known personal finance expert and founder of MoneySavingExpert.com, has issued a call to action for approximately 2.6 million households in the UK to claim council tax support that could provide them with an average of £1,300 annually. Many eligible families are unaware of this financial assistance, leading to significant losses in potential benefits.

The council tax support scheme, available to residents in England, Scotland, and Wales, can reduce council tax bills by as much as 100%, depending on individual circumstances. Despite its availability, many individuals receiving Universal Credit and Pension Credit do not realize that they need to apply separately for this support.

According to research from the firm Policy in Practice, the average financial support could significantly ease the burden for those who qualify. Martin Lewis highlighted that many workers, families, and pensioners, who have contributed to the system over the years, are often hesitant to apply for benefits, thinking they do not qualify. He emphasized that this perception is frequently incorrect.

“Millions of workers, families, and pensioners have paid into the system for years and are in need of help but think ‘benefits aren’t for people like me’ or ‘I won’t qualify,’” Lewis stated. “Often that’s wrong. Benefits are both a political hot potato and a lifeline to many struggling to get by, including millions of people who are in work and on low incomes.”

The application process for council tax support varies by local authority, which means that the amount of support available differs depending on where one lives. Lewis expressed frustration that many individuals miss out on essential financial assistance due to a lack of awareness about the need for separate applications.

“Frustratingly, many people who qualify for Universal Credit and Pension Credit miss out on this as they don’t know you need to apply for it separately,” he noted. “Every council runs its own scheme, so what you get depends on where you live, but it can cut your council tax bill by up to 100%.”

Council tax is a fee paid annually to local authorities, contributing to local services and infrastructure. The amount owed is determined by the value of the property and the number of adults residing in it, typically including all over-18s. Low-income individuals can apply for support from their local councils, which will assess eligibility based on personal circumstances, household income, and dependents.

According to GOV.UK, individuals may be eligible for council tax support if they are on a low income or claiming benefits. “Your bill could be reduced by up to 100%. You can apply if you own your home, rent, are unemployed, or working,” the government website states.

Lewis’s campaign aims to empower those who may be eligible for financial assistance but are unaware of their rights and options. With the potential for significant savings, he encourages eligible households to investigate their entitlements and apply for support. As the cost of living continues to rise, this financial help could prove crucial for many struggling households across the UK.

-

Health3 months ago

Health3 months agoNeurologist Warns Excessive Use of Supplements Can Harm Brain

-

Health3 months ago

Health3 months agoFiona Phillips’ Husband Shares Heartfelt Update on Her Alzheimer’s Journey

-

Science1 month ago

Science1 month agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Science1 month ago

Science1 month agoNASA Investigates Unusual Comet 3I/ATLAS; New Findings Emerge

-

Science4 weeks ago

Science4 weeks agoScientists Examine 3I/ATLAS: Alien Artifact or Cosmic Oddity?

-

Entertainment4 months ago

Entertainment4 months agoKerry Katona Discusses Future Baby Plans and Brian McFadden’s Wedding

-

Science4 weeks ago

Science4 weeks agoNASA Investigates Speedy Object 3I/ATLAS, Sparking Speculation

-

Entertainment4 months ago

Entertainment4 months agoEmmerdale Faces Tension as Dylan and April’s Lives Hang in the Balance

-

World3 months ago

World3 months agoCole Palmer’s Cryptic Message to Kobbie Mainoo Following Loan Talks

-

Science4 weeks ago

Science4 weeks agoNASA Scientists Explore Origins of 3I/ATLAS, a Fast-Moving Visitor

-

Entertainment4 months ago

Entertainment4 months agoLove Island Star Toni Laite’s Mother Expresses Disappointment Over Coupling Decision

-

Entertainment3 months ago

Entertainment3 months agoMajor Cast Changes at Coronation Street: Exits and Returns in 2025